Is Real Estate Investing Right for You?

Some people think having a good career, buying a home, and being free of credit card debt are all you need to achieve financial success. They are happy to continue working at their 9 to 5 jobs, pay their mortgage every month, and invest in their retirement accounts. When they retire at 60 (or older), they will own their home free and clear, and use social security and their 401K money for monthly expenses. There is nothing wrong with this, but more and more people are looking for a different way.

A Different Lifestyle

If you’re tired of the 9 to 5 grind, investing in real estate could be your path to achieve financial independence and retire early. Most successful investors can spend more time doing the things they love. Instead of worrying about deadlines or a pushy boss, they work a few hours every month. Many investors purchase luxurious vacation homes that can also earn money on VRBO and AirBNB. The first step to unlocking this freedom is getting together enough cash for your first down payment on a new property.

Hacking Your Home

If you own your home, a Home Equity Line of Credit can provide you with cash for a down payment on an investment property. Your local bank or credit union can provide you with current rates. The more equity in your home, the more cash you can borrow on a Home Equity Line of Credit. Your home equity is equal to the current value of your home (check Zillow for current estimate) minus the amount you still owe the bank (check your most recent mortgage statement). If you put down a large down payment when you bought your house, have been paying your mortgage down for a long time, or live in an area with rising property values, there’s a good chance you will qualify for a Home Equity Line of Credit.

Finding the Right Property

There are many factors to consider when selecting a property, but location is the most important. When considering a location, you should consider as much data about the area as possible, but population growth may be the most important factor. Choose an area with high population growth to ensure that your rentals will stay in high demand for years to come.

Running the Numbers

When you’ve narrowed it down to a handful of properties, you will need to do a financial analysis to see which one to choose and how much to offer for it. Sometimes when you run the numbers, what looked like a good deal turns out to be a shaky investment. To find the right deal for you, use a free investment property analysis tool to calculate your net cash flows and other financial metrics. A rule that many investors swear by is the One Percent Rule, which states that your gross monthly rents should be greater than or equal to one percent of property’s total purchase price.

Share

Recommended Posts

Is Remote Work Best for Your Lifestyle?

July 27, 2022

Newport Folk Festival features stage powered by bicycles

July 27, 2022

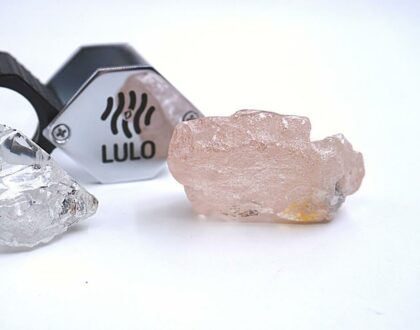

Largest pink diamond in 300 years discovered in Angola

July 27, 2022